Can you ace these KPMG Past Questions? Start honing your skills with some past questions practice and get a preview of what you can expect on test day. We pulled these KPMG job questions from our study pack KPMG Past Questions and Answers- 2022 Updated

FREE SAMPLE KPMG Aptitude Test Past Questions And Answers

Question 1

If the number of Accepted Parts produced was 20% lower this May than last May, how many Accepted Parts were produced last May?

A. 167,500

B. 170,500

C. 176,600

D. 187,500

Solution

Step 1 – Calculate what 1% would be if 150,000 is 80%.

150,000 / 80 = 1875

Step 2 – Multiply that by 100 to work out 100%.

1,875 x 100 = 187,500

Therefore last May, 187,500 Accepted Parts were produced (if this year saw a 20% decrease).

Question 2

If Total Parts continued to decrease at the same rate as between April and May, how many would be produced in June?

A. 129,600

B. 128,400

C. 132,200

D. 136,400

Solution

Step 1 – Calculate the actual difference between April and May.

250,000 – 180,000 = 70,000

Step 2 – Work out what 70,000 is as a percentage of 250,000 (April’s Total).

70,000 / 250,000 x 100 = 28%. The Total produced went down by 28%.

Step 3 – Work out what 72% of 180,000 is.

(1-0.28) x 180,000 = 129,600

Question 3

What is the ratio of Rejected Parts to Accepted Parts in February?

A. 1:10

B. 0.2:1

C. 0.5:1

D. 5:1

Solution

Step 1 – Compare number of Rejected Parts to Accepted Parts in February.

50,000 : 250,000

Step 2 – Divide the lowest by the highest.

50,000/250,000 = 0.2

Step 3 – This equates to 0.2 : 1.

Question 4

What was the ‘Total Parts produced’ less ‘Rejected Parts produced’ across and including February to May?

A. 680,000

B. 720,000

C. 760,000

D. 700,000

Solution

Step 1 – Sum the Total Parts for February to May.

300,000 + 210,000 + 250,000 + 180,000 = 940,000

Step 2 – Sum the Rejected Parts for February to May.

50,000 + 40,000 + 60,000 + 30,000 = 180,000

Step 3 – Subtract the Rejected Parts in Step 2 from the Total Parts in Step 1.

940,000 – 180,000 = 760,000

OR YOU CAN SIMPLY SUM THE ‘ACCEPTED PARTS’ FROM FEB TO MAY!

Question 6

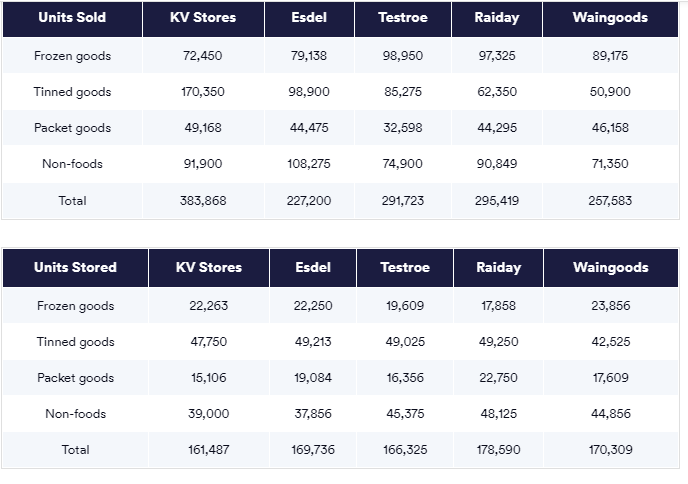

For which of the five stores did Non-foods represent more than 30% of their total Units sold?

A. Ralday and Testroe

B. Esdel and Waingoods

C. Waingoods and KV Stores

D. KV Stores and Testroe

E. Esdel and Ralday

Solution

Step 1 – For each retailer, calculate the % value of the Household sales

KV Stores: (91,900 / 383,868)*100 = 24%

Esdel: (108,275 / 227,200) * 100 = 48%

Testroe: (74,900 / 291,723) * 100 = 26%

Ralday: (90,849 / 295,419) * 100 = 31%

Waingoods: (71,350 / 257,583) * 100 = 28%

Step 2 – Review step 2’s answers to work out which of the figures is greater than 30.

This reveals that only Esdel and Ralday have sold Non-food units that make up more than 30% of the total units sold.

Question 7

The five stores in the table make up 75% of the entire market in terms of Total Units sold. There are two other stores that make up the remaining market share. How many units have the other two stores sold in the same period?

A. 19,411

B. 58,232

C. 194,106

D. 485,264

E. 770,642

Solution

Step 1 – Calculate the Total Units sold for the five stores shown.

383,868 + 227,200 + 291,723 + 295,419 + 257,583 = 1,455,791

Step 2 – If 1,455,791 represents 75% of the Total Units sold, we can use this to calculate the 100% value

1,455,791 / 75 = 19,410.55

19,410.55 x 100 = 1,941,054.67

Step 3 – If 1,941,054.67 represents the total marketplace, we now need to work out the 25% for the stores not shown in the table.

1,941,054.67 x 25% = 485,264

Question 8

Looking at the Units sold for Testroe and Ralday, for which category of goods is there a greater than 20% difference in value?

A. Packet goods and Non-foods

B. Non-foods and Packet goods

C. Tinned goods and Non-foods

D. Tinned goods and Packet goods

E. Packet goods and Frozen goods

Solution

Step 1 – Calculate the % difference in value for each category of Units sold.

Frozen goods = 1% difference

Tinned goods = 27% difference

Packet goods = 26% difference

Non-foods = 18% difference

Step 2 – Review Step 1 to determine which are greater than 20% making the correct answer Tinned goods and Packet foods.

Question 10

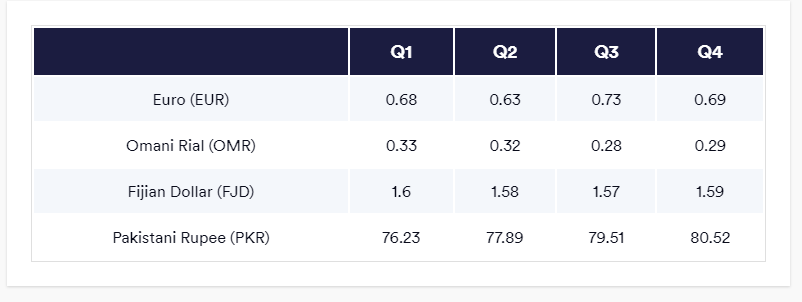

What is the percentage change in the value of the EUR from Q2 to Q4 compared to the CAD?

A. 9.5% decrease

B. 8.7% decrease

C. 6.0% decrease

D. 8.5% increase

E. 10.5% increase

Solution

Step 1 – From the table you can see that 1 CAD will buy you more EUR in Q4 than Q2. This shows that the value of the EUR has decreased in value. Calculate the percentage change.

((0.69 – 0.63) / 0.63) x 100 = 9.5% decrease

Question 11

OMR 750 was used to buy CAD in Q1 and then converted back to OMR in Q4. How many OMR did this buy?

A. 589

B. 659

C. 712

D. 789

E. 815

Solution

Step 1 – Calculate how many CAD you can buy with OMR 750 in Q1.

OMR 750 / 0.33 = 2,272.73

Step 2 – Calculate how many OMR you can buy with CAD in Q4.

2,272.73 x 0.29 = 659.09

Question 12

Which currency depreciated the most in value against the CAD between Q1 and Q4?

A. Euro

B. Omani Rial

C. Fijian Dollar

D. Pakistani Rupee

E. Cannot tell

Solution

Step 1 – Calculate the percentage change in the value of each currency between Q1 and Q4.

EUR (0.69 – 0.68) / 0.68 x 100 = 1.5%

OMR (0.29 – 0.33) / 0.33 x 100 = -12.1%

FJD (1.59 – 1.6) / 1.6 = -0.6%

PKR (80.52 – 76.23) / 76.23 = 5.6%

One Canadian dollar would buy you 80.52 PKR in Q4 versus 76.23 in Q1.

Want more questions like this? Get the KPMG Past Questions and Answers- 2022 Updated, with even more questions and answers ![]()